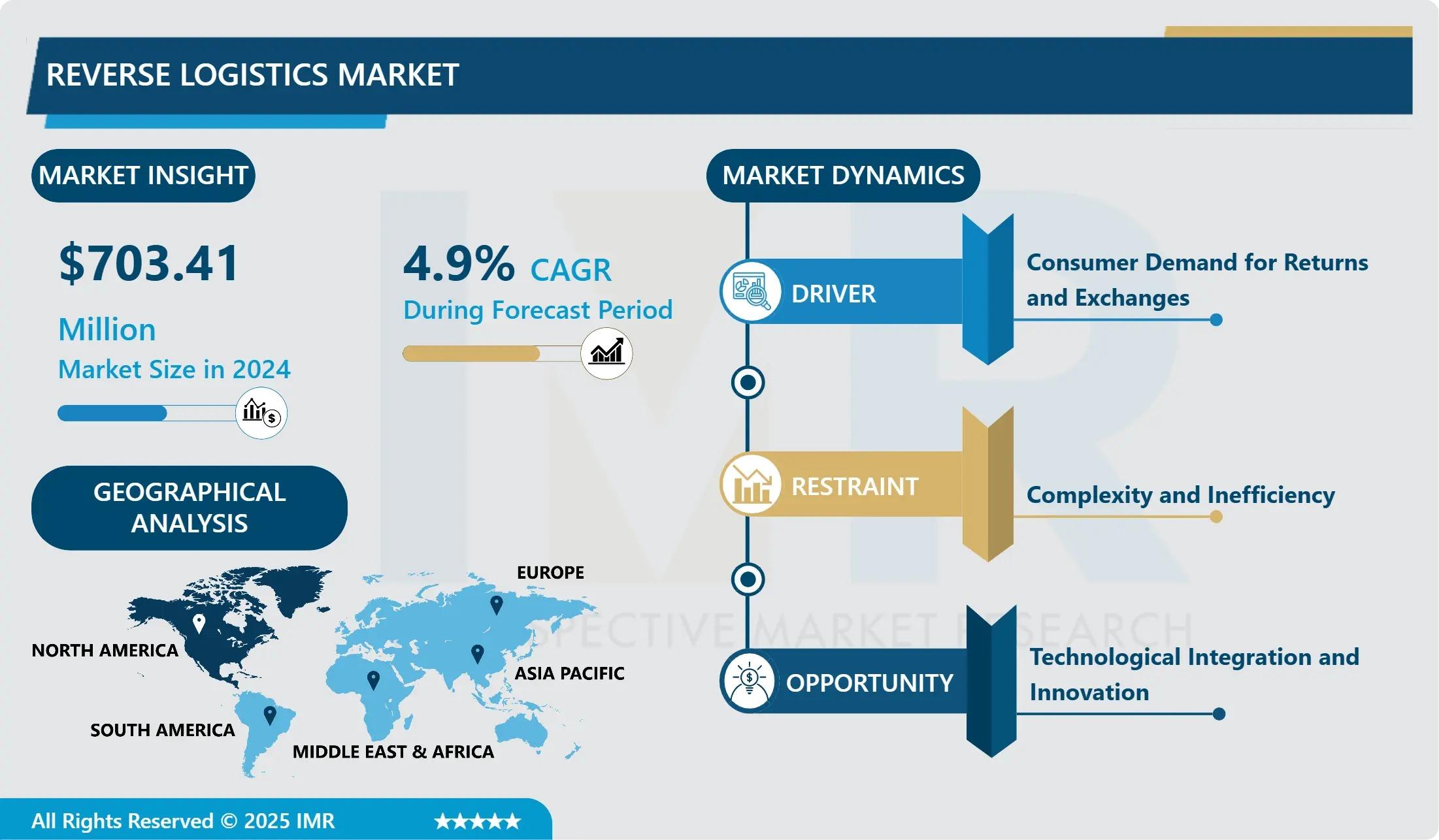

According to a new report published by Introspective Market Research, Reverse Logistics Market by Service Type, End-User, Return Type, and Region, The Global Reverse Logistics Market Size Was Valued at USD 703.41 Billion in 2024 and is Projected to Reach USD 1031.37 Billion by 2032, Growing at a CAGR of 4.9%.

Market Overview:

The global Reverse Logistics market encompasses the specialized process of moving goods from their final destination back to the point of origin for the purpose of recapturing value, ensuring proper disposal, or facilitating returns, repairs, recycling, and refurbishment. Unlike traditional forward logistics, this process involves managing product returns, recalls, excess inventory, and end-of-life products. The key advantages of a well-managed reverse logistics system over ad-hoc returns handling are significant cost recovery, enhanced customer satisfaction and loyalty, improved sustainability through recycling and remanufacturing, and compliance with growing environmental regulations regarding product stewardship and circular economy principles.

Growth Driver:

The dominant growth driver for the reverse logistics market is the explosive and sustained growth of the global e-commerce sector, accompanied by increasingly liberal return policies that have made product returns a standard consumer expectation. The convenience of online shopping has led to return rates that are significantly higher than those of brick-and-mortar stores. Managing this massive, complex, and costly flow of returned goods efficiently has become a critical competitive differentiator for retailers. This necessity forces companies to invest in sophisticated reverse logistics networks and technologies to streamline returns processing, minimize losses, recover value through restocking or resale, and maintain customer loyalty in a highly competitive marketplace, thereby creating continuous demand for specialized services.

Market Opportunity:

A substantial and high-value market opportunity lies in the integration of advanced technology and data analytics to create intelligent, automated, and sustainable reverse logistics ecosystems. Leveraging Artificial Intelligence (AI) and machine learning can optimize return routing, automate quality inspection and sorting, and dynamically determine the most profitable disposition path (resell, refurbish, recycle) for each returned item. Furthermore, the growing focus on the circular economy opens opportunities for specialized services in high-value asset recovery, such as remanufacturing automotive parts, refurbishing medical devices, and responsibly recycling electronic waste (e-waste). Developing closed-loop supply chain solutions and offering "logistics-as-a-service" platforms for returns management represent lucrative avenues for growth, especially in serving small and medium-sized enterprises (SMEs) that lack in-house capabilities.

Reverse Logistics Market, Segmentation

The Reverse Logistics Market is segmented on the basis of Service Type, End-User, and Return Type.

End-User

The End-User segment is further classified into Retail & E-commerce, Automotive, Consumer Electronics, Pharmaceuticals, and Others. Among these, the Retail & E-commerce end-user segment accounted for the highest market share in 2024. This segment is the primary engine of the reverse logistics market, driven by the sheer volume of returns generated by online shopping. Retailers and e-commerce giants require efficient systems to handle returns quickly, restock sellable items, process refunds, and manage customer communication, making this by far the largest and most dynamic end-user category.

Service Type

The Service Type segment is further classified into Returns Management, Refurbishing, Remanufacturing, Packaging, and Others. Among these, Returns Management accounted for the highest market share in 2024. This core service involves the entire process from authorizing a return to receiving the product, inspecting it, and processing a refund or exchange. It is the foundational and most frequently required service across all industries, especially in e-commerce, forming the bulk of the activity and revenue within the reverse logistics value chain.

Some of The Leading/Active Market Players Are-

• UPS Supply Chain Solutions (USA)

• FedEx Corporation (USA)

• Deutsche Post DHL Group (Germany)

• XPO Logistics, Inc. (USA)

• Kintetsu World Express, Inc. (Japan)

• Reverse Logistics Group (Germany)

• Optoro, Inc. (USA)

• Liquidity Services, Inc. (USA)

• C.H. Robinson Worldwide, Inc. (USA)

• CEVA Logistics (CMA CGM) (France)

• GXO Logistics, Inc. (USA)

• Happy Returns (A PayPal Company) (USA)

• Ryder System, Inc. (USA)

• Re-Teck (China)

• Bar Code Integrators, Inc. (USA)

• and other active players.

Key Industry Developments

News 1:

In March 2024, Optoro launched an AI-powered returns platform that uses computer vision to automatically assess the condition of returned items and instantly assign them the optimal resale channel (e.g., direct resale, wholesale, liquidation), dramatically reducing processing time and maximizing recovery value for retailers.

News 2:

In January 2024, Deutsche Post DHL Group announced a major expansion of its "Reversify" service, a dedicated circular economy logistics solution that helps automotive and electronics clients design and operate take-back programs for end-of-life products, focusing on parts harvesting and material recycling to meet new EU sustainability regulations.

Key Findings of the Study

• The Retail & E-commerce end-user segment dominates, driven by high return volumes from online shopping.

• The Asia-Pacific region is the fastest-growing market due to booming e-commerce and manufacturing activity.

• The exponential growth of e-commerce with liberal return policies is the primary growth driver.

• Key trends include the adoption of AI and automation for returns processing and a strategic shift towards circular economy models involving refurbishment and remanufacturing.