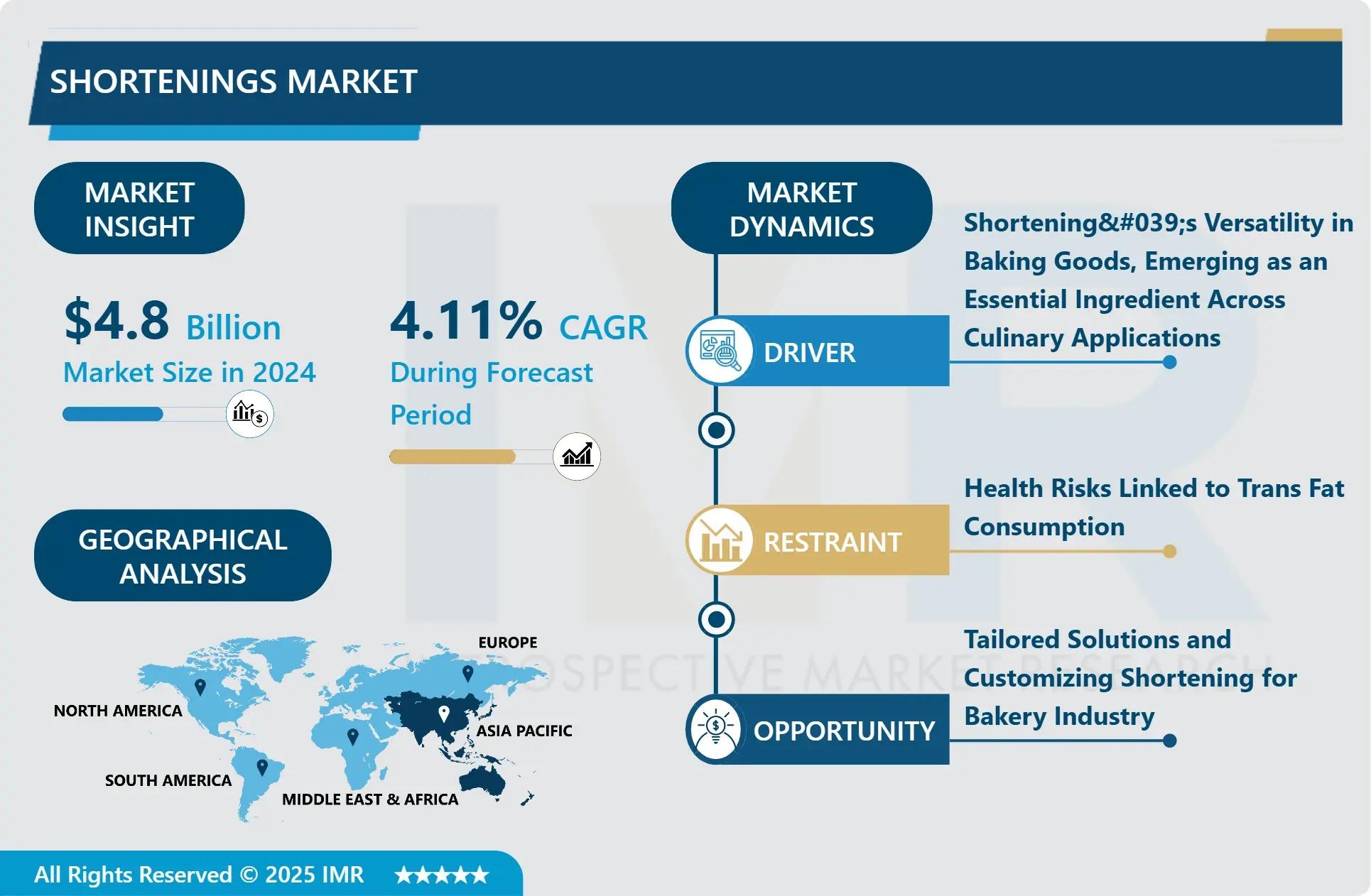

According to a new report published by Introspective Market Research, Shortenings Market by Product Type, Form, Application, and Region, The Global Shortenings Market Size Was Valued at USD 4.8 Billion in 2024 and is Projected to Reach USD 6.62 Billion by 2032, Growing at a CAGR of 4.11%.

Market Overview:

The global Shortenings market consists of semi-solid fats used in food preparation to impart texture, structure, and richness, primarily by inhibiting gluten formation in flour. This category includes vegetable shortenings, lard, margarine, and specialty bakery fats. The key advantage of modern shortenings over traditional fats like butter or lard lies in their functional properties: they have a higher smoke point for frying, provide superior flakiness and tenderness in baked goods, are more shelf-stable, and are often formulated to be trans-fat-free and lower in saturated fats. These characteristics are essential for consistent, large-scale food production.

Growth Driver:

The primary growth driver for the shortenings market is the robust and expanding global bakery and snack food industry, fueled by changing consumer lifestyles, urbanization, and the rising popularity of convenience and indulgence foods. The demand for consistent, high-quality baked goods—from artisanal bread to mass-produced pastries and cookies—requires standardized, high-performance fats that ensure texture, volume, and shelf life. Similarly, the fried snacks segment relies on shortenings with stable frying properties. The proliferation of bakeries, cafes, and fast-food outlets worldwide, especially in emerging economies, creates sustained, volume-driven demand for shortenings as essential industrial ingredients. This growth is further supported by the constant need for product consistency and cost-effectiveness in large-scale food manufacturing.

Market Opportunity:

A significant market opportunity lies in the development and commercialization of next-generation, functionally superior, and nutritionally improved shortenings. This includes creating "drop-in" solutions that are free from trans fats, lower in saturated fats, and made from sustainable, non-GMO, or identity-preserved oils (like high-oleic sunflower or canola) to meet clean-label and health-conscious trends. There is also a growing opportunity in plant-based and vegan shortenings that perform identically to traditional options, catering to the expanding plant-based food market. Furthermore, specialty shortenings tailored for specific applications such as those optimized for laminated dough (croissants), gluten-free baking, or high-stability frying allow manufacturers to command premium prices and build strong partnerships with industrial bakeries and food processors seeking technical edge and product differentiation.

Shortenings Market, Segmentation

The Shortenings Market is segmented on the basis of Product Type, Form, and Application.

Application

The Application segment is further classified into Bakery, Confectionery, Snacks & Savory, and Household/Retail. Among these, the Bakery sub-segment accounted for the highest market share in 2024. Bakery applications are the largest and most critical, as shortenings are indispensable for creating the desired crumb structure, tenderness, and flakiness in products like cakes, pastries, cookies, and pie crusts. The sheer scale and global reach of commercial bakery production, from large industrial plants to in-store supermarket bakeries, drive consistent, high-volume demand for various types of shortening, making this the dominant revenue-generating segment.

Product Type

The Product Type segment is further classified into Vegetable Shortenings, Animal-based Shortenings, and Margarine. Among these, Vegetable Shortenings accounted for the highest market share in 2024. Vegetable shortenings, derived from palm, soybean, canola, and sunflower oils, dominate due to their versatility, longer shelf life, neutral flavor, and the industry's shift away from animal fats and trans fats. They can be hydrogenated or interesterified to achieve desired melting points and textures, making them the workhorse ingredient for most industrial baking and frying applications globally.

Some of The Leading/Active Market Players Are-

• Cargill, Incorporated (USA)

• Archer Daniels Midland Company (ADM) (USA)

• Bunge Limited (USA)

• AAK AB (Sweden)

• Wilmar International Limited (Singapore)

• Ventura Foods, LLC (USA)

• Manildra Group (USA)

• Conagra Brands, Inc. (USA)

• Associated British Foods plc (UK)

• J.M. Smucker Company (USA)

• Fuji Oil Holdings Inc. (Japan)

• IOI Corporation Berhad (Malaysia)

• Musim Mas Holdings (Singapore)

• Olenex (Switzerland/Netherlands)

• Richard Pierre Foods (USA)

• and other active players.

Key Industry Developments

News 1:

In February 2024, Cargill launched a new range of "Eversys" high-stability, non-hydrogenated palm-based shortenings designed for the demanding frying operations of snack food manufacturers. The product promises extended fry life and reduced oil absorption, targeting cost-efficiency and consistent product quality for large-scale producers.

News 2:

In December 2023, AAK announced a breakthrough in its "koavan" range with a new shortening made from shea and mango kernel fats, offering a 30% reduction in saturated fat content while maintaining the baking performance required for laminated pastries, directly addressing the health and functionality needs of artisan and industrial bakeries.

Key Findings of the Study

• The Bakery application segment dominates due to the essential role of shortenings in texture and structure.

• The Asia-Pacific region is the fastest-growing market, driven by expanding bakery and foodservice sectors.

• The global expansion of the bakery and snack food industry is the key growth driver.

• Major trends include the development of trans-fat-free, sustainable, and functionally specialized shortenings, alongside a growing demand for plant-based and clean-label options.