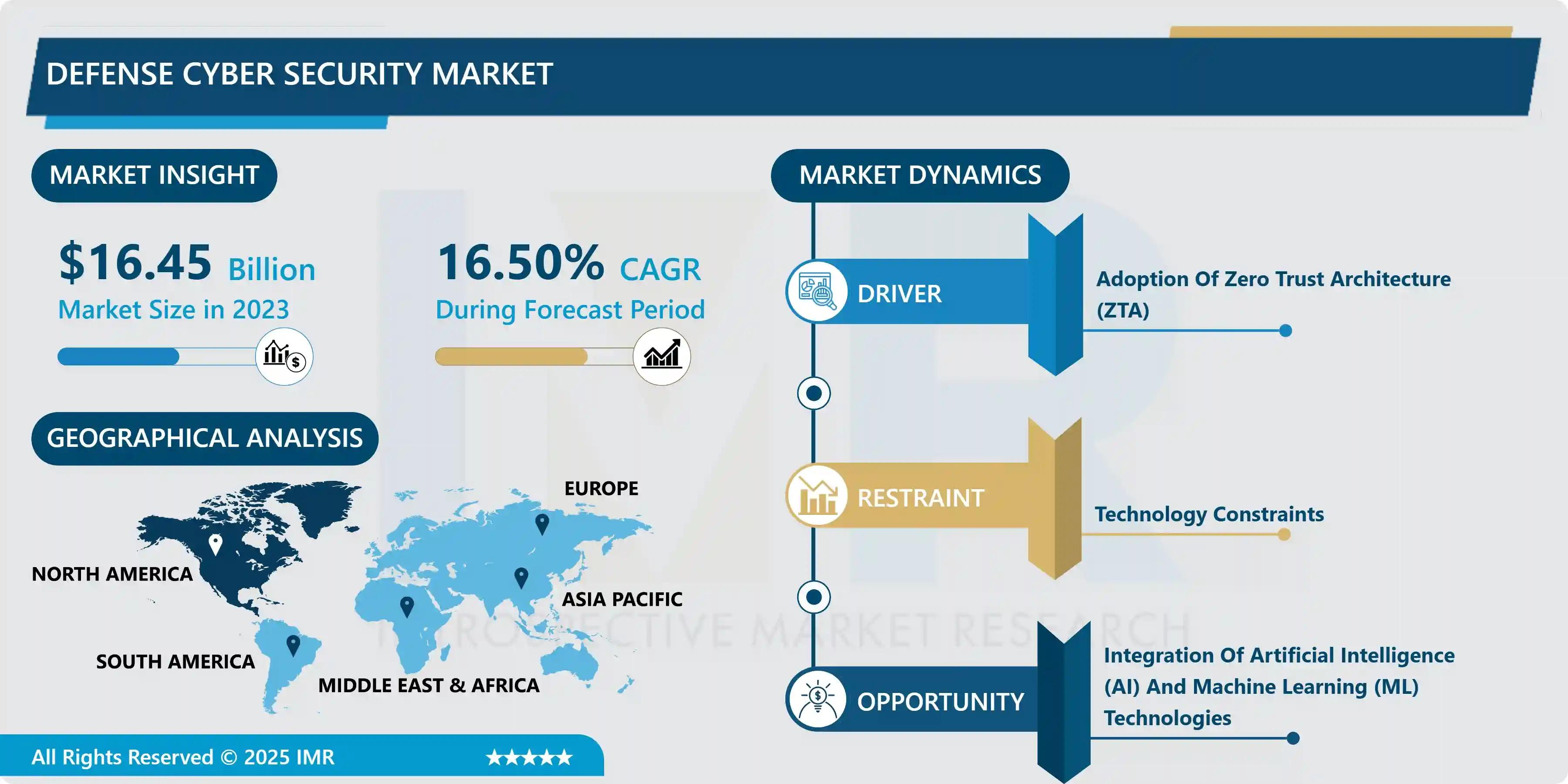

According to a new report published by Introspective Market Research, Defense Cyber Security Market by Security Type, Deployment Mode, and End User, The Global Defense Cyber Security Market Size Was Valued at USD 16.45 Billion in 2023 and is Projected to Reach USD 64.38 Billion by 2032, Growing at a CAGR of 16.5%.

Market Overview:

The Defense Cyber Security Market plays a critical role in safeguarding national security infrastructure, military communication networks, and classified defense data from increasingly sophisticated cyber threats. Defense cyber security solutions include advanced threat detection systems, encryption technologies, network security platforms, endpoint protection, and cyber intelligence services designed specifically for military and government defense applications.

Growth Driver:

A key growth driver of the Defense Cyber Security Market is the rapid increase in cyber warfare incidents and rising geopolitical tensions worldwide. Governments are significantly increasing defense budgets to strengthen cyber defense capabilities and protect critical military infrastructure. The growing adoption of digital technologies, connected battlefield systems, IoT-enabled defense equipment, and satellite communication networks has expanded the attack surface for cyber threats. As a result, defense organizations are investing heavily in advanced cyber threat intelligence, zero-trust architecture, and AI-powered security platforms to ensure real-time threat detection, data protection, and uninterrupted mission operations.

Market Opportunity:

A major market opportunity lies in the integration of artificial intelligence, machine learning, and quantum-resistant encryption technologies into defense cyber security frameworks. As military operations become increasingly data-driven, the need for predictive threat analytics and automated response systems is growing rapidly. Emerging domains such as space defense and autonomous defense systems require highly secure and resilient cyber infrastructures. Additionally, partnerships between defense agencies and private cybersecurity firms are creating innovation ecosystems that accelerate the development of next-generation cyber defense solutions, particularly in emerging economies modernizing their military capabilities.

The Defense Cyber Security Market is segmented on the basis of Security Type, Deployment Mode, and End User.

Security Type

The Security Type segment is further classified into Network Security, Endpoint Security, Application Security, Cloud Security, and Others. Among these, the Network Security sub-segment accounted for the highest market share in 2023. Network security remains fundamental in defense environments due to the need to protect communication channels, tactical networks, and data transmission systems from intrusion and cyber espionage. Advanced firewalls, intrusion detection systems, and secure communication protocols are widely deployed across defense infrastructures. As military systems become more interconnected, robust network security solutions are essential to prevent unauthorized access and ensure operational integrity.

Deployment Mode

The Deployment Mode segment is further classified into On-Premises and Cloud-Based. Among these, the On-Premises sub-segment accounted for the highest market share in 2023. Defense organizations prefer on-premises deployment due to strict data sovereignty requirements, confidentiality concerns, and control over classified information. On-premises solutions provide enhanced customization, direct oversight, and compliance with national security regulations. While cloud adoption is increasing, sensitive military operations continue to rely heavily on secure, internally managed cyber security infrastructures to mitigate external risks.

Some of The Leading/Active Market Players Are-

- Lockheed Martin Corporation (USA)

• Raytheon Technologies Corporation (USA)

• Northrop Grumman Corporation (USA)

• BAE Systems plc (UK)

• Thales Group (France)

• Leonardo S.p.A. (Italy)

• L3Harris Technologies, Inc. (USA)

• Booz Allen Hamilton Holding Corporation (USA)

• General Dynamics Corporation (USA)

• Airbus SE (Netherlands)

• SAIC (USA)

• Elbit Systems Ltd. (Israel)

• Cisco Systems, Inc. (USA)

• IBM Corporation (USA)

and other active players.

Key Industry Developments

News 1:

In April 2024, a leading defense contractor announced the expansion of its cyber security division to address rising cyber warfare threats.

The company introduced advanced AI-powered threat detection platforms designed for military applications. The initiative aims to enhance cyber resilience across defense communication networks and strengthen collaboration with government agencies on national cyber defense programs.

News 2:

In January 2024, a major aerospace and defense firm secured a multi-year contract to provide integrated cyber security solutions for military infrastructure modernization.

The contract focuses on upgrading secure communication systems and implementing zero-trust architecture frameworks. This development reflects the growing emphasis on strengthening digital defense capabilities amid evolving cyber threats.

Key Findings of the Study

- Network Security dominates the security type segment.

• On-Premises deployment leads the market.

• North America remains a major revenue contributor.

• Growth driven by rising cyber warfare threats.

• AI-driven cyber defense is a key emerging trend.