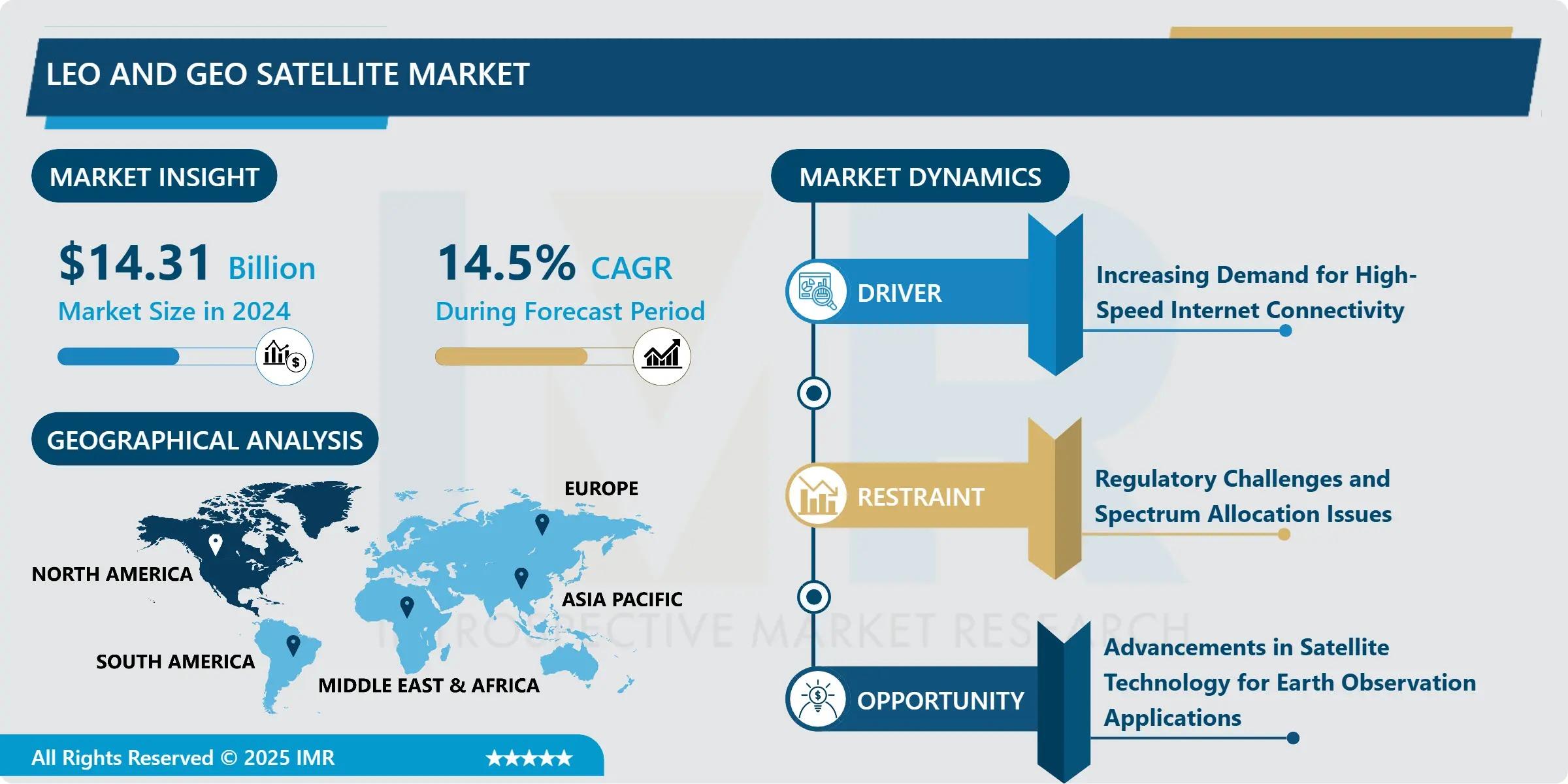

According to a new report published by Introspective Market Research, LEO and GEO Satellite Market by Orbit Type, Application, End-User, and Region, The Global LEO and GEO Satellite Market Size Was Valued at USD 14.31 Billion in 2024 and is Projected to Reach USD 42.27 Billion by 2032, Growing at a CAGR of 14.5%.

Market Overview:

The global LEO (Low Earth Orbit) and GEO (Geostationary Earth Orbit) Satellite market encompasses the manufacturing, launch, and operation of satellites in these two primary orbital regimes, each offering distinct advantages. LEO satellites, orbiting at altitudes of 160-2,000 km, provide low-latency, high-bandwidth communication ideal for global broadband internet (e.g., Starlink, OneWeb), real-time Earth observation, and IoT connectivity. In contrast, GEO satellites, positioned at ~35,786 km, remain fixed over a single point on Earth, making them perfect for traditional broadcast television, weather monitoring, and secure military communications. The combined market leverages the complementary strengths of both orbits to create integrated, resilient space-based infrastructure.

Growth Driver:

The primary growth driver for the LEO and GEO satellite market is the unprecedented surge in global demand for ubiquitous, high-speed, low-latency connectivity, particularly from the rapid deployment of LEO broadband mega-constellations. Companies like SpaceX (Starlink), Amazon (Project Kuiper), and OneWeb are launching thousands of small satellites to provide global internet coverage, bridging the digital divide for rural and remote areas and offering competitive alternatives to terrestrial fiber. This demand is compounded by the insatiable need for data from IoT devices, autonomous systems, and government/military applications requiring secure, resilient communication networks. The commercial race to dominate space-based internet, supported by falling launch costs and scalable satellite manufacturing, is the most potent force fueling the market's expansion.

Market Opportunity:

A transformative market opportunity lies in the development of hybrid multi-orbit networks that seamlessly integrate LEO, GEO, and potentially MEO (Medium Earth Orbit) satellites. This architecture, often called "Integrated Satellite Networks," combines the high throughput and low latency of LEO with the wide-area coverage and stability of GEO. Service providers can offer tiered, reliable connectivity solutions for critical applications like autonomous shipping, in-flight connectivity, and government operations. Furthermore, the rise of satellite-as-a-service and data analytics platforms presents a massive opportunity. Companies can move beyond selling bandwidth to offering turnkey solutions—such as real-time maritime tracking, precision agriculture insights, or disaster response monitoring—by processing raw satellite data into actionable intelligence for enterprise and government clients.

LEO and GEO Satellite Market, Segmentation

The LEO and GEO Satellite Market is segmented on the basis of Orbit Type, Application, and End-User.

Orbit Type

The Orbit Type segment is further classified into Low Earth Orbit (LEO) and Geostationary Earth Orbit (GEO). Among these, the Low Earth Orbit (LEO) sub-segment accounted for the highest market share in 2024 and is expected to grow at the fastest rate. LEO's dominance is fueled by the explosive deployment of commercial broadband constellations. The lower cost of manufacturing small satellites, the reduced launch costs enabled by reusable rockets, and the superior performance for interactive internet services are driving massive private investment into LEO, positioning it as the most dynamic and high-growth segment of the entire space industry.

Application

The Application segment is further classified into Communication, Earth Observation & Remote Sensing, Navigation, and Scientific Research. Among these, the Communication application segment accounted for the highest market share in 2024. This includes broadband internet, backhaul for mobile networks (4G/5G), and broadcast services. The universal need for connectivity, the limitations of terrestrial infrastructure in remote regions, and the strategic importance of secure military satcom ensure that communication remains the largest revenue-generating application for both LEO and GEO satellites.

Some of The Leading/Active Market Players Are-

• SpaceX (USA)

• OneWeb (UK)

• Amazon (Project Kuiper) (USA)

• Intelsat S.A. (Luxembourg)

• SES S.A. (Luxembourg)

• Eutelsat Group (France)

• Thales Alenia Space (France/Italy)

• Airbus Defence and Space (Europe)

• Boeing Company (USA)

• Lockheed Martin Corporation (USA)

• Northrop Grumman Corporation (USA)

• L3Harris Technologies, Inc. (USA)

• Maxar Technologies (USA)

• Planet Labs PBC (USA)

• Spire Global, Inc. (USA)

• and other active players.

Key Industry Developments

News 1:

In March 2024, SpaceX launched another batch of its next-generation Starlink satellites with direct-to-cellphone capabilities, marking a significant step in its plan to provide global mobile connectivity and directly compete with terrestrial cellular networks, especially in underserved areas.

News 2:

In February 2024, Intelsat and SES, two GEO satellite giants, announced a strategic partnership to develop multi-orbit service packages that combine their GEO fleets with LEO capacity from third-party providers. This move highlights the industry trend towards integrated, flexible network solutions to meet diverse customer needs.

Key Findings of the Study

• The Low Earth Orbit (LEO) segment dominates and is growing fastest, driven by broadband mega-constellations.

• The Communication application is the largest revenue contributor, fueled by global internet demand.

• The massive deployment of LEO constellations for global broadband is the key growth driver.

• Major trends include the move towards hybrid multi-orbit networks, the rise of satellite-as-a-service, and direct satellite-to-device connectivity.https://faithstreamer.com/